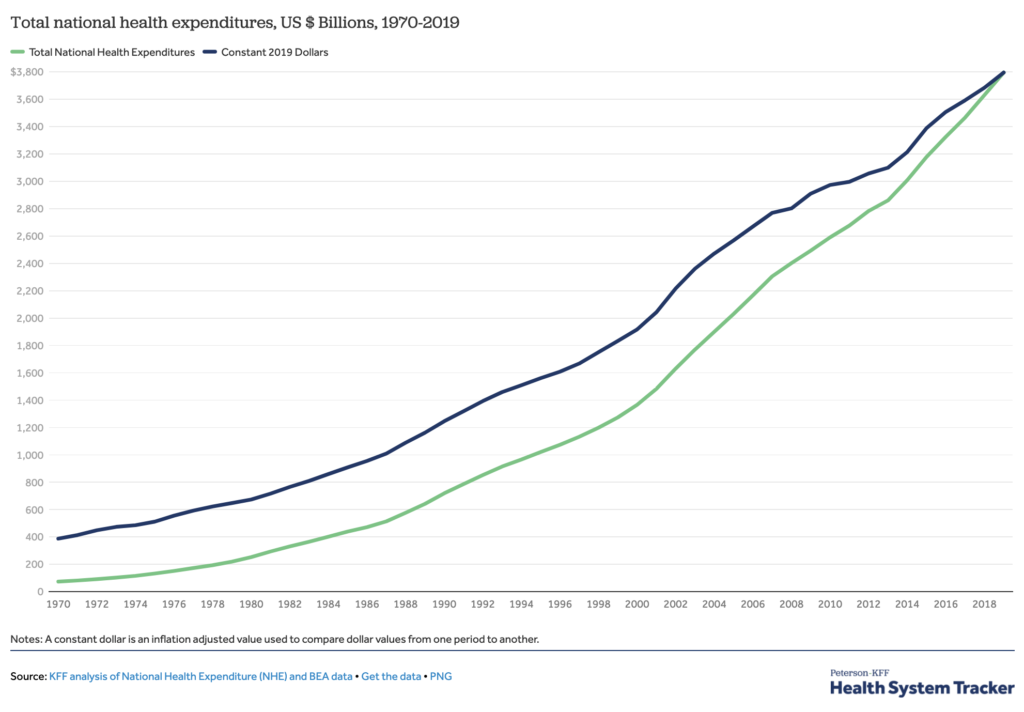

According to the Peter G. Peterson Foundation, the U.S. has one of the highest costs of healthcare in the world. In 2018, the United States spent about $3.6 trillion on healthcare, which averages to about $11,000 per person. An article by Health System Tracker echoed this sentiment, stating that prior to the pandemic, healthcare costs not only represented a huge expense, but also outpaced the rate of inflation year after year.

The rise in healthcare costs continues to impact healthcare premiums and employees’ out of pocket costs, as well as the unexpected expenses associated with catastrophic loss.

That’s where stop loss coverage comes in

Unlike fully insured coverage, which assumes 100% of the risk in exchange for an agreed upon premium amount, regardless of the claims frequency or severity, a self-funded plan puts the financial risk in the hands of the employer allowing payments to be made for the claims incurred and services rendered.

Employer Stop Loss acts as a financial safeguard while protecting health plans or employers against catastrophic and unpredictable losses. Stop Loss is purchased by employers who have decided to self-insure their employee benefit plans, but cannot assume 100% of the financial liability.

Under a stop loss policy, the stop loss carrier becomes liable for losses that exceed the predetermined amounts, known as Specific and Aggregate coverage:

- Specific Stop Loss is a form of excess coverage that provides protection for the employer against a high dollar claim on any one individual. This protects against abnormal severity of a single claim. Specific stop loss is also known as individual stop loss.

- Aggregate Stop Loss provides a ceiling on the dollar amount of all eligible claims that an employer would pay, in total, during a contract (policy) period. The carrier reimburses the employer after the contract period for the amount exceeding the aggregate stop loss, if any.

It’s time to invest in Stop Loss

By incorporating stop loss into your insurance risk management practices, you are limiting your financial exposure by safeguarding against high claims. Employers who integrate these concepts into their insurance strategies are taking this one-step further and investing in technologies that they can utilize to show historic cost trends and forecast potential future costs.

Your stop loss partner should care about your healthcare costs as much as you do, and this is what USBenefits Insurance Services does best.