When measuring a stop-loss carrier’s/MGU’s claim handling, turnaround time on claims may come up, along with how easy the claim area is to work with. Again, you rarely hear how the stop-loss carrier/MGU helps the client reduce the claim costs.

At USBenefits, we focus on claim handling and work hard to deliver savings to clients so their renewal premium is as low as possible. We do this by having a detailed list of cost-containment opportunities and strategies we have developed over many years; we know generate claim savings. Our list of cost-containment opportunities can be found on our website and we share it with all our payer partners to ensure we are working closely in the client’s best interest. This is not a magic bullet but requires industry expertise and a lot of work analyzing claims, while ensuring you have the right vendors in place with the knowledge and determination to review difficult claim situations. Consider the following example, which most of us can relate to… You’re car shopping, and the decision has come down to two cars. One is cheaper, while the other is more reliable and dependable. We’ve all advised friends and family and generally know how this ends.

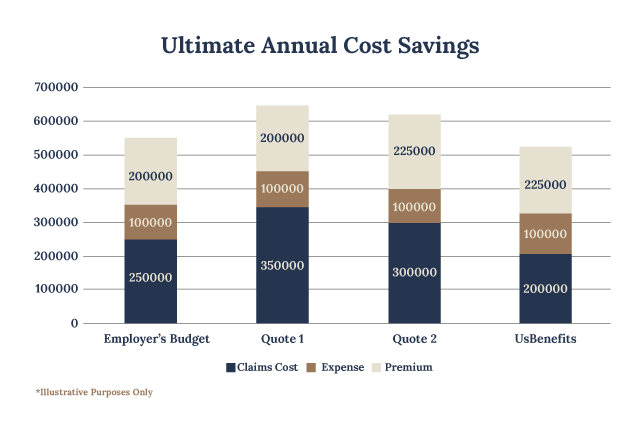

The graph below is an illustrative example of why, at USBenefits, we believe claim handling is just as, or even more important, than price. In a tight market, the price paid is usually pretty close when you get to the point of making a final decision. In the last two years, USBenefits has reduced the stop-loss claim expense by an average of 30% for our clients. You can see a few of our claim success examples on our website.

Your goal is our goal – to provide the best possible outcome for the employer. To ensure this commitment, we are not incentivized or influenced by any third party, so we work only in your and your client’s best interest.